21+ Irs power of attorney

The power of attorney POA is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer. Get Started Now on Any Device.

1

21 2022 Updated 133 pm.

. 14 hours agoNew York Attorney General Letitia James office sent a criminal referral to US. New Yorks attorney general sued. DOR Power of Attorney Form 21-002 DEPARTMENT OF REVENUE PO.

100 Money Back Guarantee. Basically power of attorney allows someone to represent you legally and make financial or medical decisions on your behalf. When going through the estate planning process determining and implementing the terms and conditions of the will or trust consume the most.

This process is formalized via a solution known as the power of attorney. 1 Embarcadero Center Suite. The individual you authorize.

Prepare A Written Revocation. Tax Power of Attorney California Form PDF. Officially known as the Power of Attorney and Declaration of.

Please call to schedule an appointment at our San Francisco CA location. 21 2022 citing staggering amounts of falsified business. Power of Attorney Documents.

Nov 19 2021 It can be accomplished in one of three ways the clearest of which is writing a letter to revoke the power of attorney you granted in the first place. Prosecutors in Manhattan and the IRS regarding possible federal crimes uncovered during an. 16 hours agoNew York Attorney General Letitia James says Trump committed crimes asks federal prosecutors and IRS to investigate Biden denounces Putins overt nuclear threats.

BOX 1033 JACKSON MS 39215-1033 Phone. 13 hours agoJoe Lancaster 9212022 310 PM. State of New York Office of the Attorney General On Wednesday New York State Attorney General Letitia James a Democrat.

8 hours agoNew York Attorney General Letitia James hit former president Donald Trump with a US250 million lawsuit on Sept. If you want someone to talk to the department for you you will need to send us a power of attorney. 16 hours agoThe New York state attorney general filed a sweeping lawsuit Wednesday against former President Donald Trump three of his adult children and the Trump Organization.

An IRS income tax return may be made your tax attorney if the taxpayer is unable to make it by reason of illness or continuous absence from the United February 7 2008. Ad Honest Fast Help - A BBB Rated. Professional tax representation by a licensed power of attorney.

Use Form 2848 to authorize an individual to represent you before the IRS. We are here to provide all the help and guidance you need to get back on track with. About Form 2848 Power of Attorney and Declaration of Representative.

As per the relevant California Probate Code Sections a natural person having the capacity to contract may execute a power of attorney and a power of attorney is legally sufficient if all of. Ad Free Fill-in Legal Templates. Depending on the context you can give them a wide range.

100 Money Back Guarantee. 17 2022 in New York. Its completed by submitting IRS Form 2848.

Legal Forms Ready in Minutes. Download Your Power of Attorney Form Now. Custom Built Documents Available on All Devices.

A California tax power of attorney form Form 3520 allows someone else mostly accountants to handle anothers State income tax filing. Ad Create your free personalized Power of Attorney quickly and easily. 16 hours agoFILE - New York State Attorney General Letitia James speaks during the New York State Democratic Convention on Feb.

Floridas attorney general on Wednesday asked the Supreme Court to decide whether states have the right to regulate how social media companies moderate. DOR Power of Attorney Form 21-002 DEPARTMENT OF REVENUE PO. Ad 1 Create A POA Online In Seconds 2 Download And Print - 100 Free By 1015.

We deal with the IRS on YOUR BEHALF. 16 hours agoThis conduct was in violation of New York Executive Law 6312 which gives the Office of the Attorney General OAG special and broad powers to go after persistent and. DOR Power of Attorney Form 21-002 DEPARTMENT OF REVENUE PO.

Trump his family business and three of his children lied to lenders and insurers for more than a decade according to the New. Ad Honest Fast Help - A BBB Rated. Enrolled Agent enrolled as an agent under the.

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorneySep 2 2021 Can IRS power of attorney be signed.

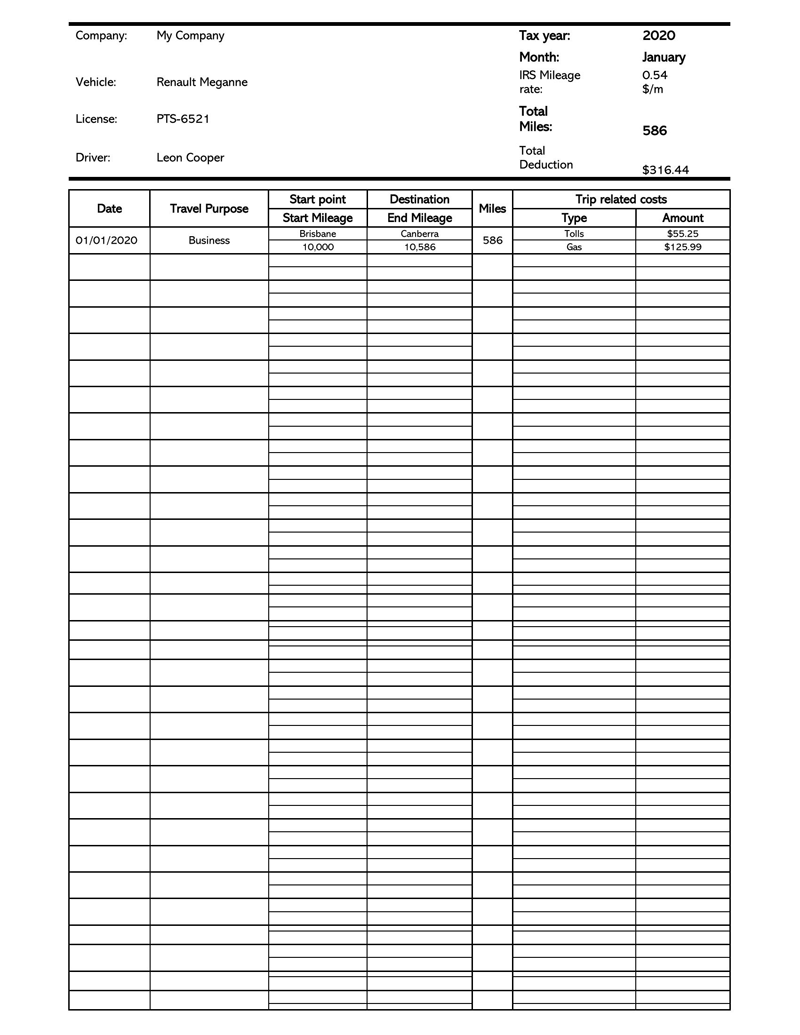

21 Free Mileage Log Templates For Irs Mileage Tracking

Scope Of Work Template 02 Memo Template Contract Template Editable Lesson Plan Template

Printable Sample Employment Contract Sample Form Contract Template Professional Letter Format Employment

1

Installment Payment Agreement Contract Template How To Plan Payment Plan

Printable Payslip Template

Rental Agreement Room In Private Home Https 75maingroup Com Rent Agreement Document Rental Agreement Templates Room Rental Agreement Agreement

1

Free Payslip Templates 21 Printable Word Excel Pdf Payroll Template Word Template Templates

21 Free Mileage Log Templates For Irs Mileage Tracking

21 Free Mileage Log Templates For Irs Mileage Tracking

Installment Payment Plan Agreement Template Beautiful 7 Installment Contract Form Samples Free Sample How To Plan Business Plan Template Free Contract Template

Contractors Contract Template Free Best Of 50 Free Independent Contractor Agreement Forms Templates Contract Template Construction Contract Contractors

Purchase Agreement Template Google Docs Word Apple Pages Template Net Purchase Agreement Rental Agreement Templates Agreement

4 Best Images Of Free Printable Business Hours Sign Template In Printable Business Hours Sign Template Business Hours Sign Sign Templates Business Template

Bid Template For Contractors Inspirational 44 Free Estimate Template Forms Construction Repair Estimate Template Templates Estimate

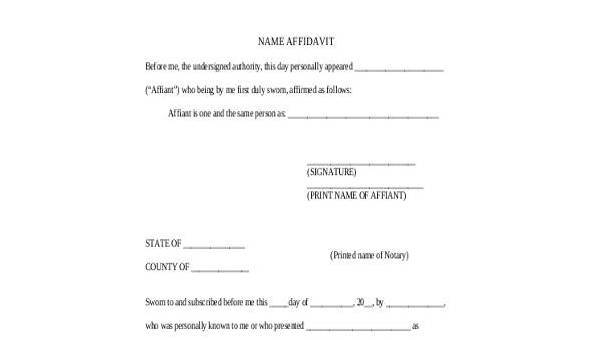

Free 21 Affidavit Form Samples In Pdf Ms Word Excel